Consumer Watch: Online Scams Surge by 40% in US Families

Recent reports indicate a significant 40% rise in online scams targeting US families over the last six months, underscoring the escalating digital threats consumers face daily.

Consumer Watch: New Data Reveals 40% Increase in Online Scams Targeting US Families in the Last 6 Months. This alarming statistic should prompt every household to reassess their digital safety practices. In an increasingly connected world, understanding the evolving landscape of cyber threats is not just advisable, it’s essential for safeguarding your financial well-being and personal information.

Understanding the Alarming Rise in Online Scams

The recent surge in online scams points to a sophisticated and adaptable criminal underworld. These aren’t just isolated incidents; they represent a concerted effort to exploit vulnerabilities in our digital lives.

The 40% increase in incidents targeting US families over the past six months is a stark reminder that no one is entirely safe. Criminals are leveraging advanced techniques, from AI-generated deepfakes to highly personalized phishing attacks, making it harder for the average user to distinguish legitimate communications from fraudulent ones.

The Evolving Tactics of Cybercriminals

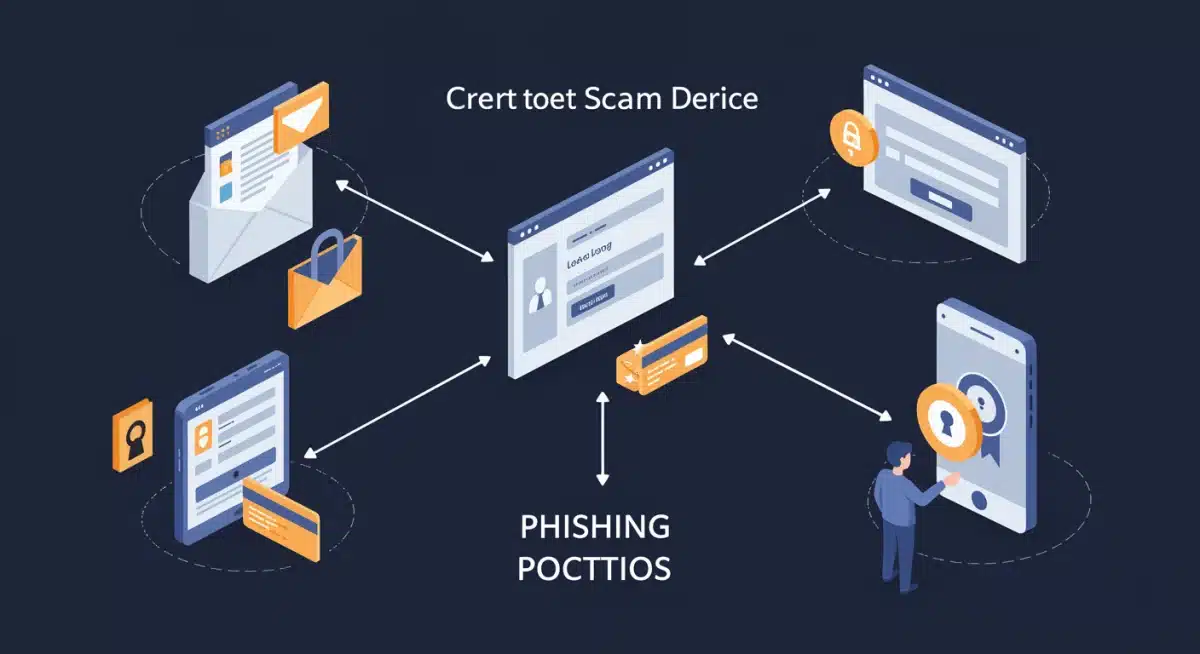

Cybercriminals are constantly refining their methods. Gone are the days of easily identifiable scam emails riddled with grammatical errors. Today’s scams are often meticulously crafted, mimicking legitimate businesses and government agencies.

- Phishing and Smishing: Attackers send deceptive emails or text messages to trick individuals into revealing sensitive information like passwords or credit card numbers.

- Impersonation Scams: Scammers pose as trusted entities, such as banks, government officials, or even family members, often exploiting emotional connections.

- Tech Support Scams: Fraudsters pretend to be technical support from well-known companies, gaining remote access to devices and stealing personal data or demanding payment for bogus services.

This evolving threat landscape demands a proactive approach to digital security. Families must stay informed about the latest scam tactics and understand the psychological tricks criminals use to create a sense of urgency or fear.

Common Online Scams Targeting US Households

Online scams come in many forms, each designed to exploit different aspects of a victim’s trust or vulnerability. Understanding the most prevalent types can significantly reduce your risk of falling victim.

From fake investment opportunities to deceptive online shopping sites, the methods are diverse. Many scams prey on common human desires, such as finding a good deal, receiving a large inheritance, or helping a loved one in distress. The emotional manipulation involved often makes these scams particularly effective.

Identifying Different Fraudulent Schemes

Scammers often target specific demographics or leverage current events to make their schemes more convincing. For instance, during tax season, tax-related phishing scams spike. During major shopping events, fake e-commerce sites proliferate.

- Grandparent Scams: A scammer pretends to be a grandchild in distress, needing urgent money.

- Romance Scams: Fraudsters create fake online profiles to build relationships and then solicit money.

- Online Shopping Scams: Fake websites or social media ads offer non-existent products at steep discounts, collecting payment without delivering goods.

- Investment Scams: Promises of high returns on fake investments, often involving cryptocurrency, entice victims to transfer large sums of money.

Being aware of these common schemes is the first step in protecting your family. Always verify requests for money or personal information, especially if they come with a sense of urgency or an unusual story.

The Financial and Emotional Toll on Families

Beyond the immediate financial losses, falling victim to an online scam can have profound and lasting impacts on individuals and families. The emotional distress, loss of trust, and psychological trauma can be just as damaging as the monetary costs.

Victims often experience feelings of shame, guilt, and anger, which can strain familial relationships and impact mental health. Recovering from a scam is not merely about recouping lost funds; it’s also about rebuilding trust and regaining a sense of security.

Long-Term Consequences of Fraud

The financial ramifications can extend far beyond the initial loss. Identity theft, for example, can lead to ruined credit scores, unauthorized purchases, and years of effort to restore one’s financial standing. Some victims even face legal issues if their identities are used for criminal activities.

The emotional toll is equally significant. Many victims report symptoms of anxiety, depression, and post-traumatic stress. The betrayal of trust, especially in romance scams, can make it difficult to form new relationships or trust others in the future. Support groups and therapy can be crucial resources for those affected.

Understanding these broader impacts highlights the importance of prevention. The cost of prevention, such as investing in cybersecurity tools or spending time educating family members, pales in comparison to the potential cost of falling victim to a scam.

Proactive Measures for Digital Protection

In light of the escalating threat, implementing robust digital protection measures is no longer optional; it’s a necessity for every US family. Proactivity is key, as waiting until a scam occurs often means it’s too late to prevent damage.

Effective protection involves a combination of technological safeguards, informed decision-making, and open communication within the household about potential risks. Each family member, regardless of age, plays a role in maintaining digital security.

Essential Cybersecurity Practices

Layered security is the most effective approach. This means combining different strategies to create multiple barriers against potential threats. No single tool or practice can offer complete protection, but together they form a strong defense.

- Strong, Unique Passwords: Use complex passwords for all accounts and enable two-factor authentication (2FA) wherever possible.

- Software Updates: Keep all operating systems, web browsers, and antivirus software updated to patch known vulnerabilities.

- Antivirus and Anti-Malware Software: Install reputable security software on all devices and run regular scans.

- Secure Wi-Fi Networks: Use strong encryption for home Wi-Fi and avoid public Wi-Fi for sensitive transactions.

Regularly reviewing and updating these practices is crucial. Cyber threats evolve, and so too must our defenses. Educating children and elderly family members about safe online habits is particularly important, as they are often targeted due to perceived vulnerabilities.

Educating Your Family: The First Line of Defense

Knowledge is power, especially when it comes to defending against online scammers. Educating every member of your family, from the youngest to the oldest, creates a collective defense mechanism that is far stronger than individual efforts.

Open discussions about the types of scams prevalent today, how to identify red flags, and what steps to take if something feels suspicious can significantly reduce the risk of someone falling victim. This ongoing education should be a regular part of family conversations.

Key Topics for Family Discussions

Tailoring the conversation to different age groups is important. For younger children, focus on not clicking on unknown links or giving out personal information. For teenagers, discuss the dangers of sharing too much on social media and the risks of online gaming scams. For older adults, emphasize the prevalence of impersonation scams and the importance of verifying unexpected requests.

- Recognizing Phishing Attempts: Teach family members how to spot suspicious emails, texts, or calls, such as generic greetings, urgent requests, or unusual sender addresses.

- Verifying Information: Emphasize the importance of independently verifying any unsolicited requests for personal or financial information, especially if they claim to be from a known entity.

- Privacy Settings: Review and strengthen privacy settings on all social media platforms and online accounts to limit the amount of personal information publicly available.

- Reporting Suspicions: Establish a clear process for reporting suspicious activities or scam attempts to a trusted family member or authority.

Consistent reinforcement of these principles is vital. Role-playing potential scam scenarios can also be an effective way to prepare family members to react appropriately when confronted with a real threat.

Reporting Scams and Seeking Assistance

Even with the best preventative measures, some individuals may still fall victim to online scams. Knowing how to report a scam and where to seek assistance is crucial for mitigating damage and helping authorities combat cybercrime.

Prompt action can often lead to a better chance of recovering lost funds or preventing further identity theft. Reporting also provides valuable data to law enforcement, helping them track trends and warn other potential victims.

Steps to Take After a Scam

The immediate aftermath of a scam can be disorienting, but acting quickly is paramount. The faster you respond, the more likely you are to limit the damage. It’s important not to feel embarrassed or ashamed; scammers are professionals at manipulation.

First, gather all available evidence, including emails, text messages, transaction records, and any other communications. This documentation will be vital for reporting the incident to the appropriate authorities.

- Contact Your Bank/Financial Institution: If money was transferred or financial information compromised, contact your bank or credit card company immediately to report the fraud and potentially reverse transactions.

- Report to Law Enforcement: File a report with your local police department and the FBI’s Internet Crime Complaint Center (IC3).

- Inform Credit Bureaus: If personal information was compromised, place a fraud alert or freeze your credit with Equifax, Experian, and TransUnion.

- Change Passwords: Change passwords for all affected accounts and any other accounts that share similar credentials.

Seeking support from victim assistance organizations can also provide emotional and practical help. These organizations can guide you through the recovery process and offer resources for rebuilding your security and peace of mind.

| Key Aspect | Brief Description |

|---|---|

| Scam Increase | A 40% rise in online scams targeting US families in the last 6 months. |

| Common Tactics | Phishing, impersonation, tech support, romance, and investment scams are prevalent. |

| Protection Measures | Strong passwords, 2FA, software updates, antivirus, and secure Wi-Fi are essential. |

| Reporting Scams | Contact banks, law enforcement (IC3), and credit bureaus immediately after a scam. |

Frequently Asked Questions About Online Scams

Online scams are escalating due to increased internet usage, sophisticated criminal tactics like AI and personalized attacks, and a lack of widespread digital literacy. The anonymity of the internet also makes it easier for fraudsters to operate without immediate consequences.

The most common types include phishing emails, impersonation scams (e.g., government, tech support, family), romance scams, fake online shopping sites, and fraudulent investment opportunities, especially those involving cryptocurrency. Always verify unsolicited requests.

Families can protect themselves by using strong, unique passwords with 2FA, keeping software updated, installing antivirus software, securing home Wi-Fi, and educating all members about scam red flags. Open communication about digital safety is crucial.

If you suspect a scam, do not engage further. Immediately cease communication, gather all evidence, contact your bank if finances are involved, report the incident to the FBI’s IC3, and change any compromised passwords. Inform credit bureaus if personal data was stolen.

While anyone can be targeted, older adults are often susceptible to impersonation and grandparent scams, while younger individuals might fall victim to online gaming or social media fraud. Education tailored to specific vulnerabilities is essential for all age groups.

Conclusion

The recent data revealing a 40% increase in online scams targeting US families serves as a critical warning. As cybercriminals become more sophisticated, our collective defense must evolve in tandem. Protecting your family requires a multi-faceted approach: understanding the varied tactics of scammers, implementing robust digital security measures, and fostering an environment of open communication and continuous education within your household. By taking proactive steps and knowing how to respond effectively if a scam occurs, families can significantly reduce their vulnerability and safeguard their financial and emotional well-being in the digital age. Stay vigilant, stay informed, and prioritize your digital security.